Are you tired of paying for private mortgage insurance (PMI) and looking for ways to remove it from your mortgage? Look no further. This definitive guide covers everything you need to know about PMI removal, from understanding its impact on your mortgage to exploring different strategies and alternatives to eliminate it. Buckle up and get ready to save money and increase your home equity. For more detailed information, don’t forget to download our quick-read info sheet on this topic!

Key Takeaways

- Understand PMI and its impact on a mortgage.

- Explore the different types of mortgage insurance available, as well as strategies for PMI removal.

- Consider legal rights & responsibilities, costs & benefits, and alternatives to PMI when navigating the process.

Understanding PMI and Its Impact on Your Mortgage

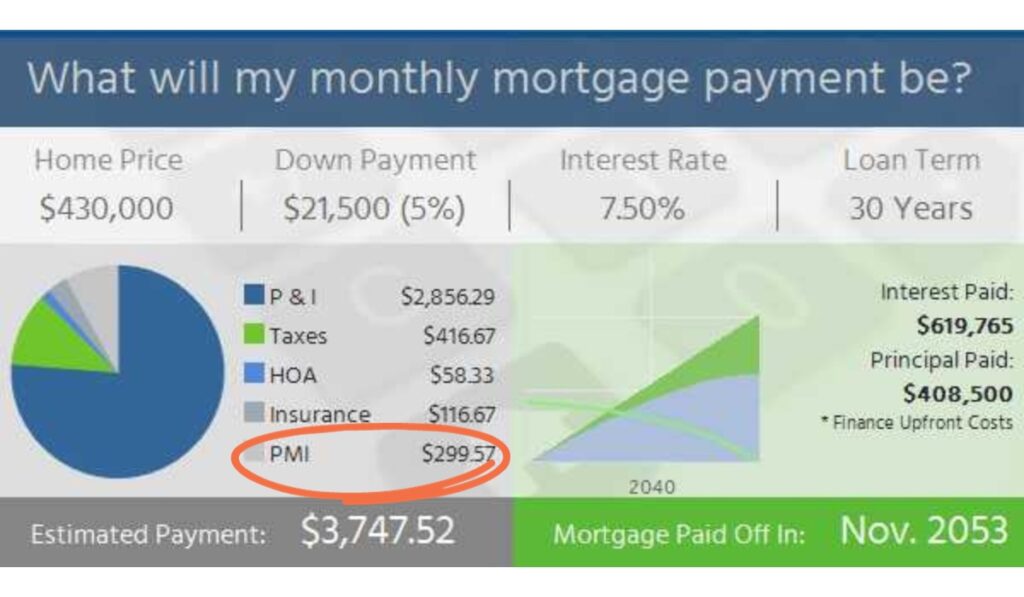

Private Mortgage Insurance (PMI) is an insurance policy that protects mortgage lenders in case a borrower defaults on their loan repayments. While it might seem like an insignificant detail, PMI can have a substantial impact on your mortgage payments. The cost of PMI varies and is based on a number of factors including the number of borrowers, property type, credit score, and loan amount. It can also change based on the type of program you’re looking at. For the purposes of this article we will be referring to conventional loans.

The good news is that you can get rid of PMI once you reach a certain level of equity in your home. As you continually reduce your mortgage balance and your home value appreciates, you will have multiple avenues for eliminating PMI. This could mean significant savings and lower monthly mortgage payments for you.

The Different Types of Mortgage Insurance

Mortgage insurance comes in three main forms.

- Borrower paid mortgage insurance monthly (BPMI): The borrower is responsible for the payment of premiums on a monthly basis as part of their mortgage payment. This is the most common.

- Lender-paid mortgage insurance (LPMI): The lender assumes the responsibility of the PMI premium, often incorporating the cost into the mortgage through a higher interest rate or a larger loan amount.

- Borrower paid single premium (SP): The borrower can buy out the mortgage insurance upfront with an additional cost payable at closing.

Understanding your specific type of mortgage insurance is key, as it directly influences your PMI removal process. While BPMI can be removed, LPMI is already part of the agreed upon interest rate and won’t change. Single premium will have already been bought out and therefore there is no mortgage insurance to remove.

Key Factors Affecting PMI Cancellation

The journey to PMI cancellation involves understanding several key factors, such as:

- The loan-to-value (LTV) ratio: the ratio of the outstanding balance of the mortgage’s principal to the appraised value of the home.

- Payment history: ensuring that you are current on your payments.

- Home value: cancellation can depend on either the original home value or a new, appraised value depending on the option(s) available.

You can request PMI cancellation once your LTV ratio reaches 80%. Lenders will typically want to see that you’ve made 1-2 years of payments on your mortgage before considering this request.

Alongside the LTV ratio, your payment history also significantly impacts the PMI cancellation. To be eligible for PMI cancellation, borrowers must have a record of making their mortgage payments on time and must not have missed any payments. By staying on top of these factors, you can ensure a smoother journey towards PMI removal and enjoy the financial benefits that come with it.

Strategies for PMI Removal

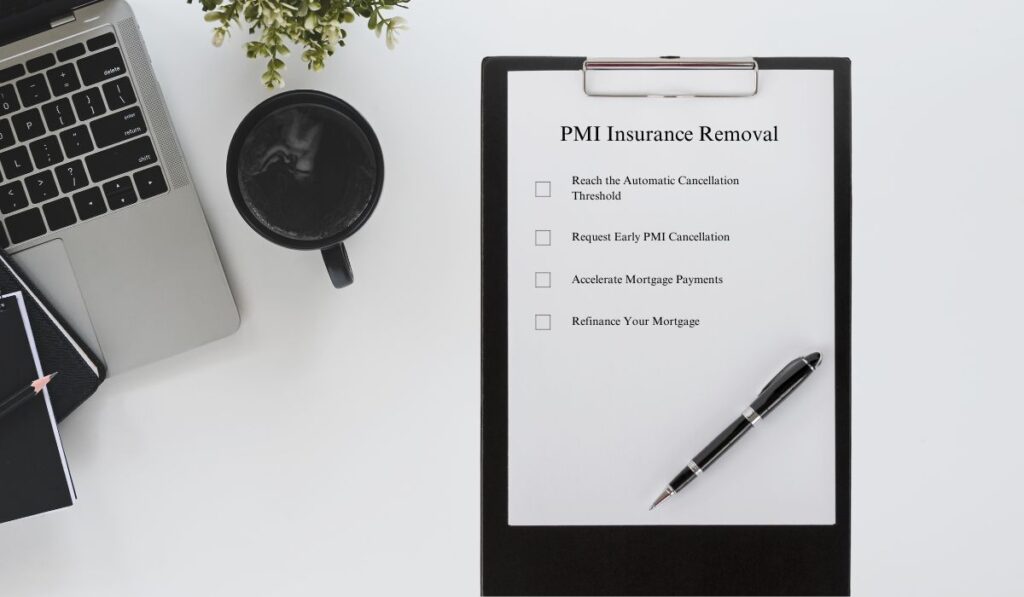

Now that you have a grasp on the factors affecting PMI cancellation, let’s explore the four main strategies for PMI removal:

- Reaching the automatic cancellation threshold

- Requesting early PMI cancellation

- Accelerating mortgage payments

- Refinancing.

Each strategy presents unique benefits and drawbacks; hence understanding the most suitable one for your situation is imperative.

Reach the Automatic Cancellation Threshold

Automatic cancellation occurs when your loan balance reaches 78% of the original value of your home or at the halfway point of your loan term. A 30-year mortgage is split into two parts: one half spans 15 years, the other half the remaining 15 years. At the end of the first 15 years, the borrower reaches the halfway point.

By being proactive about automatic PMI cancellation, you can ascertain the exact month in which your PMI should no longer be included in your mortgage payment, and you can take the necessary steps to cancel PMI.

Maintaining a record of your mortgage payments and staying informed about your loan balance is vital for reaching the automatic cancellation threshold. Regularly reviewing your mortgage statement can help you monitor your progress and ensure you’re on the right track towards automatic PMI cancellation.

Request Early PMI Cancellation

If you’re eager to get rid of PMI sooner, you can request early cancellation once your LTV ratio reaches 80% based on your home’s current value. However, early cancellation comes with certain requirements, such as demonstrating an acceptable payment history and not having a second mortgage, like a home equity loan or line of credit.

Before investing in a new appraisal for early PMI cancellation, consult with your lender to understand their specific process and requirements. Keep in mind that they may require an appraisal and may decline your request if your home’s value has decreased since its purchase.

Accelerate Mortgage Payments

Accelerating your mortgage payments can help you reach the required equity threshold faster, either through extra payments or biweekly payments. To figure out the mortgage balance required to get PMI cancellation eligibility, you have to multiply the amount paid for the original home purchase price by 0.80. This result will give you a good estimate of the final mortgage balance eligible for PMI cancellation.

The process of reaching the equity threshold and reducing your loan balance can be delayed by making additional mortgage payments or increasing your monthly payment amount. This strategy not only helps you eliminate PMI, but also reduces your overall interest costs and shortens the term of your mortgage.

Refinance Your Mortgage

Refinancing can be a powerful tool for eliminating PMI, as it allows you to obtain a new loan without PMI or with more favorable terms, such as a lower interest rate if rates have gone down. The overall loan-to-value would be based on a new appraisal and would need to be less than or equal to 80% in order to remove mortgage insurance.

Another option, besides a conventional loan or an FHA loan, is a piggyback loan, which involves obtaining a second loan for 10% of the home value in addition to a first mortgage for 80% of the home value, thus allowing you to avoid PMI.

Note that refinancing does have its own costs, such as closing costs and prepaids/escrows so a careful evaluation of the benefits and drawbacks is necessary before proceeding.

Increasing Home Value to Facilitate PMI Removal

Homeowners can increase their home’s value through renovations or expansions, which can help them reach the required equity threshold for PMI removal. Some ways to increase home value include updating hardware, creating usable outdoor spaces, and modernizing the home’s appearance.

Increasing your home’s value may enable you to achieve the necessary equity amount for PMI elimination earlier, allowing you to enjoy the financial benefits sooner. However, it’s essential to carefully consider the costs and potential return on investment of any home improvement projects before proceeding.

Legal Rights and Responsibilities Regarding PMI

The Homeowners Protection Act outlines borrowers’ rights and lenders’ responsibilities regarding PMI cancellation and disclosure, including the use of a PMI disclosure form. According to the Act, lenders are legally required to cancel mortgage insurance upon the borrower fulfilling the criteria, such as reaching the required LTV ratio.

Being well-versed in your rights and responsibilities under the Homeowners Protection Act can strengthen your position on the path to PMI removal. By staying informed about your legal rights, you can ensure a smoother process and hold your lender accountable for their obligations.

The Costs and Benefits of PMI Removal

PMI removal can lead to significant cost savings, as it reduces your mortgage payments and eliminates the need to pay for mortgage insurance premiums. The savings can be substantial, especially if your PMI cost is on the higher end of the typical range.

Considering these financial benefits, a careful evaluation of the costs and potential savings of PMI removal is vital before settling on the most suitable strategy for your circumstances.

Navigating the PMI Removal Process

Successfully navigating the PMI removal process requires understanding your equity position, communicating with your lender, and potentially obtaining a new appraisal. To comprehend your equity position, subtract the amount you owe on your mortgage from the current market value of your home.

When communicating with your lender regarding PMI removal, inquire about any fees related to the process and the documents that need to be submitted. If your lender requires a new appraisal, reach out to a certified appraiser and discuss any fees and necessary documents. If you are refinancing, then you may also want to consider the breakeven point, or how long it would take to recover the additional costs based on the monthly savings you should be realizing.

Staying proactive and informed will aid in successfully navigating the PMI removal process, enabling you to enjoy its financial benefits.

Alternatives to PMI: No-PMI Mortgages and Piggyback Loans

For those looking to avoid PMI altogether or eliminate it from their current mortgage, there are alternatives worth considering.

- No-PMI mortgages: If you qualify for a VA loan or USDA loan, those programs do not require mortgage insurance and typically have lower rates.

- Piggyback loans: This involves taking out a second mortgage to cover part of the down payment, thus avoiding the need for PMI.

- Lender-paid PMI (LPMI): In this option, the lender assumes the responsibility of the PMI premium, but this may result in a higher interest rate.

Piggyback loans, also known as 80-10-10 loans, involve obtaining a second loan for 10% of the home value, in addition to a first mortgage for 80% of the home value, which allows borrowers to avoid PMI. Weighing the pros and cons and consulting a mortgage professional before opting for one of these alternatives is critical to identifying the best option for your circumstances.

Summary

In conclusion, PMI removal can lead to significant cost savings and increased home equity. Understanding the different types of mortgage insurance, the factors affecting PMI cancellation, and the various strategies for PMI removal can empower you in your journey toward a mortgage free of insurance premiums. By staying informed, proactive, and weighing the costs and benefits of each strategy, you can make the best decision for your financial future and enjoy the rewards that come with PMI removal.

Frequently Asked Questions

Do I have to wait two years to remove PMI?

You may need to wait at least 12 months before being able to get the PMI removed. It is best to consult with your lender to see what they would require.

In any event, the lender should automatically dissolve it when you have 22% equity in the home.

What are the requirements to remove PMI?

To remove PMI, you must have owned your home for at least two years, have a history of making all mortgage payments on time, and meet the required loan to value.

You can also request that it be removed once you have 20% equity in your home.

How much does it cost to remove PMI?

PMI is automatically canceled by law, at no cost to you, when the loan balance is at or below 78% of the home’s value or once you are at the midway point of your mortgage. If you are looking to cancel it early, the fees may vary by lender and could include the cost of a new appraisal.

What is the difference between BPMI, LPMI, and SP?

BPMI is borrower-paid mortgage insurance which includes it as a monthly payment on your mortgage statement. LPMI is lender-paid mortgage insurance and rolls the mortgage insurance into the rate. SP is a single premium that you can pay upfront at closing so you do not have a monthly mortgage insurance payment.

What are the advantages of accelerating my mortgage payments?

Accelerating your mortgage payments can help reduce your overall interest costs, shorten the term of your mortgage and reach the required equity threshold faster.

Gain access to valuable market updates and stay informed about new loan products.